The Flywheel of Sports

Exploring and evaluating the business model that's driving the growth in sports franchise valuations (Part 1)

For those of you reading for the first time, welcome to Sweat Ventures! I write every other week on themes that catch my eye in the world of Fitness and Sports Investing. Thanks for joining!

Introduction

Whether it's the $6.1 billion purchase of the Washington Commanders by Josh Harris or Mark Cuban’s $3.5 billion sale of the Dallas Mavericks, the eye-popping valuations of sports franchises are a hot topic of discussion lately. Team values are at all-time highs across most leagues, and it doesn’t feel like the momentum behind the appreciation is slowing down anytime soon.

Although it’s not an apples-to-apples comparison (given liquidity constraints and the frequent need to inject additional operating capital), the chart below shows how average sports franchise valuations have performed compared to the S&P 500 from 1996 to 2021, looking strictly at publically announced enterprise valuations.

But what’s actually driving this appreciation? This post marks the first in a series that will cover exactly that. Topics will include contractual revenue streams, increasing media rights packages, high levels of operating leverage, recession resiliency, low correlation with traditional financial assets, and leagues opening their doors to institutional ownership, among others.

Before diving into specifics, I’d like to start by evaluating the business model of a sports franchise itself and how the unique intellectual property of a team brand can be monetized in different ways. When all of the multiple monetization channels are working in tandem, it can create a flywheel effect that propels the entire engine.

Jim Collins, author of Good to Great, was one of the first to coin this Flywheel Effect term as it relates to business. It refers to pushing something forward incrementally until the object's own weight helps momentum build to the point that it gathers speed with little to no effort.

The Disney Flywheel

Looking at a non-sports entity first, perhaps the best way to understand this flywheel effect is by evaluating the Walt Disney Company. Walt Disney the man is recognized for his creativity in entertainment content creation but less so for his creativity and foresight in business model creation.

Disney creates entertainment-focused content that is brought to the market through movie productions. Once there is proof of demand for the content, they leverage this IP and monetize it through distinct distribution channels. The revenue generated from a singular business unit is insignificant (by Disney’s standards, at least), but collectively, they build on each other to propel the entire engine to gather momentum, like a flywheel.

These additional channels include sequel movies, spin-off TV shows, soundtracks, licensed merchandise, publications, podcasts, themed attractions at Disney parks, Broadway Musicals, Disney on Ice, and Disney Cruises, just to name a few.

The beauty of this model is twofold. First, Disney can use the movie as a test to prove demand for the content prior to expanding into other channels. This de-risks the other business units because they know there’s demand for the content. Secondly, the more exposure a consumer gets to a Disney property, the deeper their fandom grows, allowing Disney to sell even more of a product/service and further increasing the momentum behind the flywheel. There are seemingly unlimited opportunities for Disney to place its brand on new products and services for consumers to purchase.

The movie Frozen is a perfect case study. Released in 2013, Frozen was, at the time, the 15th highest-grossing film of all time, with $1.27B in box office revenue. With a proven entertainment property in hand, Disney got to work distributing the content through the different channels of the flywheel. They sold licensing rights to manufacturers of apparel and toys ($5B in additional revenue). The Frozen Ever After attraction debuted at Disney World Epcot in 2016, and the World of Frozen attraction opened at Hong Kong Disneyland in 2023. In 2022, Disney Cruises incorporated the theme into their trips with Arendelle: A Frozen Dining Experience. The soundtrack from Frozen took on a life of its own, and the hit song “Let it Go” won an Academy Award for Best Original Song and two Grammy Awards. There is a Tony-nominated Frozen-themed Broadway musical. And finally, Disney recently released a Frozen-themed podcast, Forces of Nature, in late 2023.

Disney has gone on and utilized the core Frozen IP to launch spinoff and sequel movies, including Frozen Fever (2015), Olaf’s Frozen Adventure (2017), and Frozen II (2019), effectively starting this flywheel process over again with new content. Frozen III is set to release in 2026.

The Sports Flywheel

Sports teams share a lot of similar properties to Disney’s entertainment content. They are strong brands with fanatical support, and the ownership group of those teams can leverage and monetize that brand value in various ways. Similar to intellectual property laws that give Disney exclusive access to their content, league entities control the supply of available sports franchises and protect the geographical territories of their existing teams.

The sports brand itself is just the core of the flywheel. Historically, that brand was only utilized to draw people into stadiums to watch their favorite teams play. Increasingly, new monetization channels are opening up that are creating a similar flywheel effect. Stacking these monetization channels grows top-line revenue but also furthers that depth of connection with the fan.

There are the obvious stadium-specific revenue streams, including tickets, premium seats, in-stadium sponsorship, merchandise, food and beverage, and parking. Beyond the four walls of a stadium, newer revenue channels include:

Local media rights (radio and television)

National media rights

Out-of stadium merchandise

Licensing of data to sports betting companies

Real estate development projects using the brand of the team and stadium as an anchor tenant

Live in-person experiences outside the sporting venue itself

Brand partnerships and sponsorships

Behind-the-scenes and lifestyle entertainment (Drive to Survive, Welcome to Wrexham, Sunderland Till I Die)

Case Study: Atlanta Braves

As an example of this flywheel concept, let’s look at the Atlanta Braves of the MLB. The Braves are the oldest continuously operated professional sports team in the US (1871) and are unique in that they are one of the few publically traded professional sports franchises (NASDAQ: BATRA). SEC Filings, such as their 10k, will allow us to see their business with a level of granularity that can’t be captured with most teams.

Atlanta Braves Holding Inc. was spun off as a separately traded vehicle in 2023. It was originally part of Liberty Media Corporation’s portfolio, which also included notable sports properties such as Formula 1, Sirius XM, and Overtime Sports. There are still intercompany transactions and relationships between the two entities, but the new Braves Hold Co. is a fairly clear picture of the Atlanta Braves’ financials.

Total Revenue

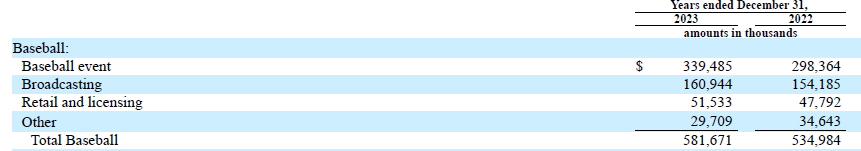

Braves Holdings reported $640,667,000 of total revenue in 2023. This breaks down into two major categories: Baseball Revenue (90.8% of total) and Mixed-Use Development Revenue (9.2% of total).

Drilling in a bit further, Baseball Revenue can be broken down into Baseball Events: 58.4% of 2023 Baseball Revenue, Broadcasting Revenue: 27.7% of 2023 Baseball Revenue, Retail and Licensing Revenue: 8.9% of Baseball Revenue, and Other: 5.0% of Baseball Revenue.

Baseball Event Revenue

Like all major professional sports teams, the majority of total revenue still comes from “butts and beers in seats.” This includes ticket sales, concessions, suites and premium seating, in-stadium sponsorships, team-specific sponsorship (jersey patches), parking, and in-stadium merchandise.

In 2017, the Atlanta Braves opened Truist Park in Cobb County, Georgia. This $722M stadium, largely financed through public sources of capital, seats 41,200, including 4,200 premium seats across 30 suites. Braves Holding doesn’t own the stadium directly; rather, they have exclusive use through a 30-year Stadium Operating Agreement with Cobb County and Cobb-Marietta Coliseum and Exhibit Hall Authority. The county benefits from the tax revenue and the development of the surrounding area (more on this below), in addition to being allowed three special events in the stadium per year, excluding concerts and sports.

The Braves averaged 38,142 fans per game in 2023, and using per-cap estimates for parking, merch, and concessions, I project the revenue of these individual channels below.

Broadcasting Revenue

Broadcasting Revenue is the next largest contributor to total revenue. This category can be broken down further into National Media Revenue and Local Media Revenue.

National Media

The MLB negotiates national media contracts on behalf of all 30 Major League teams. They currently have deals with ESPN/ABC, Fox, TBS/TNT, and Apple. Below is the approximate contract value and share for the Atlanta Braves (for simplicity, I assumed an even split, no league-born production costs, and no take for the league entity).

Local Media

The $160.9 total broadcast revenue, less the ~$64M in national media revenue, implies that the Braves rake in ~$96.2M in local media revenue. Teams negotiate their own local media contracts, but 48% of local revenue for all teams is pooled and split evenly among the entire league. The MLB uses this split as a tool to level the playing field for smaller market franchises.

The Braves currently have agreements with Bally South Sports and Bally Sports Southeast for local television rights. Both of these entities are owned by Diamond Sports Group, which is currently going through bankruptcy, so there is a strong possibility that they will be heading back to the negotiation table shortly.

In addition to the local television revenue, the Atlanta Braves also have the largest radio affiliate network in the MLB, with 173 local radio stations.

Retail and Licensing Revenue

In addition to selling merchandise inside the stadium during a game, the Atlanta Braves and MLB have multiple partnerships to distribute merchandise outside the stadium worldwide through a variety of outlets.

In 2015, the MLB announced a licensing and manufacturing agreement with Fanatics and Nike (interestingly, the MLB Players Association union has a minority equity stake in Fanatics). Nike would design and supply teams with uniforms (10-year $1B deal), and Fanatics would be granted product licensing rights to manufacture and distribute this Nike apparel through their various channels (this relationship has recently come under fire for poor uniform quality in the 2024 season).

In 2020, Logo Brands entered an agreement with MLB to license team brand names and distribute MLB-branded throws, pillows, and coozies to all retail channels.

In 2023, Mitchell and Ness secured rights to license and produce MLB-branded headwear for all 30 clubs.

These are just a few of the partnerships that the MLB and the Atlanta Braves have formed to allow fans to buy truly anything with their favorite team’s logo on it.

Other Revenue Sources

Although specific details aren’t provided, I imagine a lot is embedded within this Other Revenue Category, including concerts at the park, special events, and social media-generated revenue (Instagram: 1.9M followers, X: 1.6M followers, and TikTok: 932k followers).

This line item also contains the revenue generated from CoolToday Park, the spring training facility located in North Florida. This stadium has a seating capacity of 8,200 and includes a clubhouse facility and an academy for housing players, coaches, and staff.

Mixed Use Development

One of the more unique arms of the Braves flywheel is their ownership of real estate surrounding the stadium itself. The area developed around Truist Park is called The Battery and is a 2.25M square foot mixed-use development that includes other entertainment options, restaurants, boutique shopping, Omni and Aloft Hotels, apartments, and the Coca-Cola Roxy Music Venue. Additionally, the Battery includes commercial office space such as the headquarters of Comcast, SPACES, Papa Johns, TK Elevator, Southwire, and DCO Commercial Floors.

The mixed-use development has expanded the revenue potential for the Braves through rental incomes, parking, and additional advertising. With the stadium as a centerpiece, the Braves have created natural foot traffic that is enticing to other businesses and, overall, a thriving community around the ballpark.

Summary

Below is a visual of this flywheel in action. In reality, the entire web of revenue streams is even more complex and each of these boxes can be broken down further into more specific components. The important takeaway, though, is at its core, the Atlanta Braves is a brand that has the capability to create unique, 1-of-1 content on a nightly basis. The unique dynamics of professional sports allow the owners of this brand to monetize it in so many different ways to ultimately generate $640M of revenue annually. The fandom of the Braves grows deeper the more the brand is able to integrate with all aspects of a fan's life, and as it grows deeper, there is more demand for additional products and services that the Braves can offer.

Key Takeaways

Although there are some factors more impactful than others, its the collective of all of the various revenue streams that are generating momentum behind the sports flywheel. As our fandom deepens and we look for more ways to connect with our favorite sports team, return-driven institutional ownership groups and savvy league management will find new ways to monetize their unique IP.

In Part 2 of this series, I’ll explore how the long-term, contractual nature of multiple revenue drivers for sports teams is driving valuation appreciation.

Informative and well written, researched, Joel