Industry Outlook: Continuous Glucose Monitors

A deep dive on the continuous glucose monitoring industry and the startups that are making an impact.

Introduction

Built initially for people with diabetes, Continuous Glucose Monitors (CGM) are being repositioned as a tool for a broader audience of fitness enthusiasts and people looking to gain control of their metabolic health. Investment activity has followed this customer base expansion, and funding has increased into digital health startups that aim to simplify the CGM data and provide actionable insight. Although still in its nascent stages, the CGM-focused digital health industry has the potential to make an outsized impact on our country's struggle with metabolic health.

Metabolic Health Crisis

Metabolic health refers to the ability of one's body to efficiently make and use energy from the food we consume. According to the journal Metabolic Syndrome and Related Disorders there are five quantifiable metrics used to measure metabolic health:

1.) Blood Sugar Levels

2.) Triglycerides

3.) High-Density Lipoprotein (HDL) Cholesterol

4.) Blood Pressure

5.) Waist Circumference.

Globally and as a nation, we are failing miserably on these health measures, and metabolic health-related disease is perhaps the biggest and most important challenge our healthcare system must address immediately.

Poor metabolic health contributes directly to 8 of the 10 leading causes of unnatural death in the United States, with a direct correlation to heart disease, diabetes, Alzheimer's, and stroke. 128M Americans are prediabetic, and close to 90% of that group is unaware of their condition. Approximately 50% of our country is currently considered obese, and that percentage continues to climb. From a purely economic standpoint, 90% of our nation's $4T annual healthcare spending is tied to preventable chronic diseases directly resulting from metabolic health conditions. (Fitt Insider)

Peter Drucker famously said, "what gets measured, gets managed," and many startups are attempting to solve this health crisis by measuring the data used to manage metabolic health conditions. Continuous glucose monitors are biowearable medical devices, typically worn on the upper arm, that continuously monitor blood glucose levels through a small filament that punctures the skin. Blood glucose will naturally fluctuate throughout the day as our bodies respond to the food we eat, the stress we encounter, our hours and quality of sleep, and other lifestyle habits. However, metabolic health conditions are more likely to develop when this variability spikes and stays elevated. CGMs help a user see this glycemic variability data in real time. Numerous startups are building software on top of CGM devices to allow someone to interpret the data and gamify behavioral change.

Below is a chart from Fitt Insider that shows the increasing investor interest in companies looking to solve metabolic health conditions.

Historical Progression of Blood Glucose Monitoring

Blood glucose monitoring technology has been around since the 60s, and the first CGM device received FDA approval in 1999, but from my perspective, there have been three specific innovations that have led us to this more widespread commercialization:

1.) 2006: Dexcom debuted the STS model of their CGM, the first CGM that could provide real-time data (previously, data had to be collected and then downloaded to a different user interface for interpretation).

2.) 2015: Dexcom introduced its G5 model, which could connect and display the data directly to a mobile device.

3.) 2016: Abbott debuted their Freestyle Libre Pro device with a useful life of 14 days without needing to replace the patch.

These three events set the stage for the market that we see today. Devices were more convenient than ever and could integrate with a smartphone application. Since 2016, we have seen increased use cases for CGMs and investment activity in the space.

Wearables 2.0

I've discussed how the Wearable Technology industry is currently at an inflection point and transitioning into what I've called Wearables 2.0. (What’s Next for Wearable Devices) The first iteration of wearable devices was about collecting as much data as possible and leaving it up to the consumer to interpret and decide what to do with it. Wearables 2.0 is where wearable device companies, and more broadly, companies in the quantified-self vertical, will focus on creating closed-loop solutions. This will entail collecting the data, providing actionable insight based on findings, leading a consumer to change a behavior, and then collecting new data that shows the results of that change. It's at this stage that we will see a positive or negative reinforcement loop that for the most part has been missing. Collecting data hasn't been sufficient in driving positive health outcomes, and hopefully, this closed-loop reinforcement will begin to be more impactful.

What's interesting about CGMs, specifically, is because a few suppliers control the medical device market (discussed more in the risk section below), CGM-focused digital health companies need to jump to this closed-loop solution immediately. It's not enough to only collect the data, because an existing solution already exists for that purpose. Companies can only compete if they provide insight from the data and drive behavioral change so consumers will continue their subscriptions. Otherwise, someone would buy a CGM device from Abbott or Dexcom directly and track their data without using a digital health solution.

Although this is one of the most significant industry obstacles, it's also one of the most exciting elements of this space. CGM-focused companies must find a fast-track solution to quantify results and drive behavioral change.

Competitive Landscape

CGM Focused Firms

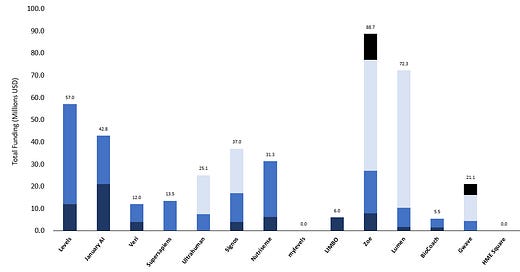

Levels Health

Levels Health has over 50,000 subscribing members and is one of the more prominent brand names in the space. Levels has a strong backing of institutional VCs, including a16z, LoupVentures, Shrug Capital, Basecamp Fund, TXV Partners, and Founder Collective. They have raised $57M in capital, most recently a $45M Series A round in January of 2023, putting the company's pre-money valuation north of $300M. Levels emphasizes the ease and quality of data collection more than AI-driven feedback or in-person nutritional support. A key differentiator with the Levels Health platform is the interoperability with both of the major CGM devices, the Dexcom G7 and the Abbott Freestyle Libre 3.

January AI

January AI's key selling point is its predictive AI capabilities that minimize the time needed with a CGM device (only 14 days of wear required). They combine data from their CGMs, heart rate monitors, and large clinical trials to feed their AI model and predict a user's glycemic response to food long after they stop using the physical CGM. The company has raised $42.8 in capital and most recently raised a $21.8M Series A round in August of 2022.

Veri

Finland-based Veri offers a comprehensive set of tools and programs in addition to a CGM subscription that a consumer can utilize to gain a better understanding of their metabolic Health. They have raised $12M in capital, most recently in June of 2022, with an $8M Series A round led by Lifeline Ventures, Accel, and PROFounders Capital. They currently utilize Abbott's Freestyle Libre 2 sensor but are evaluating integrations from numerous sensors to eventually be sensor agnostic.

Supersapiens

Supersapiens is one of the CGM companies targeting elite athletes and fitness enthusiasts specifically. The company has raised $13.5M in capital, with the most recent round in April of 2021 led by Mica Ventures with participation from WISE Ventures (Minnesota Vikings), Wahoo Fitness, Rubix Ventures, and CM Ventures. In early 2023, the NBA LaunchPad accelerator program selected Superspaiens to participate in their 2023 cohort, validating interest in this market from one of the top professional sports leagues. The company uses the Abbott Libre Sense sensor and emphasizes its integration with third-party training apps, including Garmin, TrainingPeaks, Oura Ring, Apple Watch, and Wahoo Fitness. Additionally, they pair the CGM with a wristband to see real-time data without pulling up the mobile application. The company's products are currently only available in 8 European countries, and there is no definitive timeline for when they will be available in the United States.

Supersapiens' most vital competitive advantage is their direct investment from Abbott itself. This partnership suggests potential early access to new technology or even preferred pricing on the underlying CGM devices.

As a slight aside but perhaps as a testament to the management team of Supersapiens, founder and CEO Phil Southerland was diagnosed with type 1 diabetes when he was seven months old, and despite the insurmountable health odds he faced, went on to become an avid cycler who formed the Team Type 1 cycling team, which became a top 25 professional cycling team in the world. He did this in large part because of technological advancements in blood glucose monitoring.

Ultrahuman

Bangalore, India-based Ultrahuman has raised a total of $25.1M, most recently in a Series B capital raise in May of 2022 led by Nexus Venture Partners, Blume Ventures, Steadview Capital, and iSeed. They have branded their CGM offering as "Cyborg", embracing rather than turning away from the semi-invasive nature of the CGM device. A unique differentiator with Ultrahuman is that they triangulate data from an accompanying proprietary smart ring. Ultrahuman bought smart ring maker Lazy Co. in April of 2022 to broaden its product portfolio and integrate more data into its CGM offering.

Signos

Signos is the most recent CGM-focused digital health company to raise a significant round of capital, successfully closing a $20B Series B round on 10/24 of this year. This brought their total funding to $37M. The lead investors on this B round were Cheyenne Ventures and Google Ventures, but perhaps the most notable names added to the cap table were Dexcom Ventures and Samsung. Similar to Abbott with Supersapiens, partnering with Dexcom could be a considerable advantage for Signos in the race to capture market share if it means early access to technology or favorable pricing.

Signos markets its service to a customer looking to improve metabolic health more broadly rather than focusing on more niche segments like weight loss or high-performance athletes. They use AI insight to guide consumer behavior rather than directly interacting with an in-person coach or nutritionist.

Nutrisense

Nutrisense has raised $31.5M in outside capital, most recently a $25M Series A funding round in July of 2022 led by 1315 Capital with participation from Techstars, Labor Capital, and Davidovs Venture Collective. Rather than AI-driven feedback, the Nutrisense subscription comes with access to 1-on-1 support from a nutritionist. In an interview with Fitt Insider, Nutrisense Co-Founder Dan Zavorotny mentioned he believes "that push notifications alone don't produce real behavioral change – but having guidance from a health expert in combination with real-time data can. ". It's clear that CGM companies are betting on two approaches that will drive behavior change: those focused entirely on tech-driven insight and those pairing tech-driven data with human interaction. Nutrisense uses the Abbott Freestyle Libre CGM.

myLevels

I included myLevels on this list because they utilize a CGM, but I think this is one of the weaker competitors on the market. The company is more focused on being a nutrition and dieting platform, requiring clients to order their own CGM and provide their own data. They recommend the Dexcom G7, but theoretically, they could utilize any blood glucose data. This additional hurdle to using their plan will be a significant pain point for the firm as they compete against more robust and integrated offerings. The London-based firm has not raised any institutional capital.

LIMBO

New York, London, and Cork-based Limbo announced a $6M Seed round in September 2022. The company has built its product on the private research of Dr. Tony Martin, who doesn't have an affiliation with any research institution, nor has he published any scientific papers, so the company will be banking on a differentiated approach of interpreting and responding to the data collected. Subscribers to LIMBO also receive a wearable wristband and a smart scale to provide a more holistic view of health data.

Zoe

Zoe is a personalized nutrition company that uses CGM data as one component of their diet and nutrition recommendations. The company has raised $88.7M in outside capital, most recently with a $2.5M funding round in March of 2023. They've attracted investment from Eli Manning, Transformational Healthcare, Accomplice, L Catterton, and Flight Fund, among others. In addition to the CGM sensor, they equip clients with gut health tests and blood fat tests to provide a robust data set to build on. The use of the Abbott Libre CGM is an optional add-on if users want to participate in a clinical study.

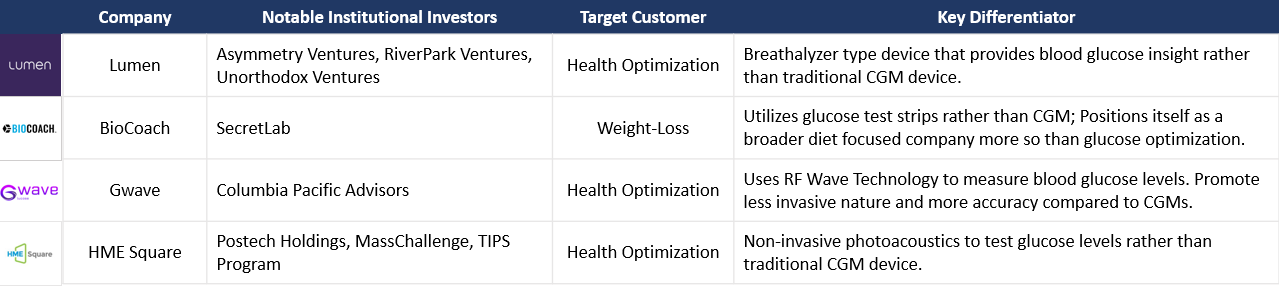

Substitute Products

In addition to the more traditional CGM blood glucose tracking devices, several startups are experimenting with other modalities to collect the same data. If successful in collecting accurate data in a less invasive manner, these companies pose a significant threat to CGM-based companies.

Lumen

Lumen is probably the most well-known and well-funded metabolic health company focused on collecting data through means other than CGMs. The Israeli-based startup uses a breathalyzer-type device that helps individuals determine if they are burning fat or carbohydrates, which is insightful for metabolic health understanding. The company has raised $72.3M in capital, most of which came through a Series B round in December 2022. Pitango VC, RiverPark Ventures, Asymmetry Ventures, Resolute Ventures, and Unorthodox Ventures participated in the Series B round.

BioCoach

Minneapolis-based company BioCoach uses more traditional and perhaps outdated finger pricks and test strips to test blood glucose levels. They promote a more comprehensive dieting and meal plan service, with glucose testing as a secondary point of emphasis. They have raised $5.5M in outside capital, most recently in a Seed Round in May of 2022 led by SecretLab.

GWave

GWave is a novel, non-invasive CGM device that uses radio frequency waves to test blood glucose levels. Preliminary studies have shown promising early results in efficacy. Earlier in 2023, parent company HAGAR raised a $5M Series C round to continue funding research efforts, bringing their total funding to $21.1M.

HME Square

South Korean firm HME Square, which uses photoacoustics to measure glucose levels, presented at this year's TechCrunch Disrupt and has shown initial studies with higher efficacy than current CGMs on the market. Although they have not publicly announced institutional capital support, if their initial efficacy studies are valid, I imagine this will be a hot target for new money or a potential acquisition target for better capitalized CGM-based companies.

Future Potential Entrants

Although these firms do not currently compete directly with a CGM-based offering, they pose a significant threat if they were to enter the market.

Apple

Apple is always a looming threat with anything related to wearable devices, and there have been rumors that they are developing CGM/blood glucose tracking technology to integrate with the Apple Watch in the near future. Their recent unveiling of the Apple Watch 9 did not have any glucose monitoring features, and analysts don't believe it will debut with the Apple Watch 10, but they have reportedly reached a proof of concept phase with a potential integration. They are evaluating an optical absorption spectroscopy process, which essentially entails collecting data by shining a small laser on the skin. Although this could still be years away, CGM-focused companies will be sure to keep an eye on Apple as they would pose a significant risk if they can successfully launch this feature.

Movano

Wearable device maker Movano has also been actively working on developing non-invasive CGM technology to integrate into their devices. Like GWave mentioned above, Movano is researching using radio frequency waves to measure blood glucose activity. In February of 2022, Movano announced the completion of an Institutional Review Board (IRB) study, bringing them one step closer to official FDA approval to roll out their devices. No definitive timeline has been set for the next steps of development.

Whoop

Whoop has not explicitly stated intentions to integrate with CGM data, but given the company is trying to become the all-encompassing user interface for a view of the human body, I would be surprised if they are not developing blood glucose tracking technology in-house or at a minimum discussing direct integration with third party FDA approved devices. Whoop is one of the stars of the quantified health movement, and its multiple billion-dollar valuation gives it deep pockets to explore different entry points in the glucose tracking space.

Garmin

In April 2023, Garmin announced direct integration with the Dexcom G6 and Dexcom G7 CGM. This announcement signals that Garmin is not as interested in competing on the medical device front but is more so prepared to build on top of the blood glucose data, a similar model to the digital health companies mentioned above. With Garmin's far reach and reputation within the endurance sports and outdoor recreation markets, this could be a legitimate threat to CGM-focused companies if they cannot provide additional value beyond what existing wearable device companies can provide.

Oura

Oura, smart ring pioneer and one of the largest wearable companies in the world, announced earlier this year that they would integrate their devices with January AI, Supersapiens, and Veri software. This partnership shows that Oura is clearly in alignment with understanding the importance of this data and perhaps indicates that they won't enter the space as a competitor directly, but it is possible that they are building out this functionality in-house to integrate with their rings in the future.

Biggest Industry Obstacles

Beyond the standard competitive dynamics, there are some unique challenges for the CGM industry as a whole, including the power of the suppliers, long-term engagement of the customer, direct integration of CGM data, and substitute products.

1.) Power of Suppliers

CGMs are FDA-regulated medical devices, an industry with considerable barriers to entry. Because of this, startups are focusing on the software layer built on top of the collected data rather than the data collection devices themselves. This means the manufacturers of the medical devices have significant pricing power and the ability to choose whom they partner with selectively. On this later point, we have already seen each of the predominant CGM manufacturers make direct investments in digital health startups:

Abbott: Manufacturer of the Freestyle Libre 2, Libre Sense, and currently-in-development Lingo has partnered and invested directly into Supersapiens.

Dexcom: Manufacturer of the G5, G6, and G7 CGMs has invested directly into Signos through their corporate venture arm, Dexcom Ventures.

Although it appears that both Dexcom and Abbott are willing to supply companies outside of their investment portfolio, the firms that have established a relationship with the manufacturer could have a clear advantage with early access to the technology and more competitive pricing.

The third primary manufacturer of FDA-approved CGMs is Eversense, but they focus on a more invasive implantable device that has not made its way into the broader wellness market.

2.) Long-Term Engagement

Long-term customer engagement is a problem that all wearable device companies face but perhaps is even more apparent with companies that use a semi-invasive piece of equipment such as a CGM. If a user wears the device for a couple of months and gains the insight they need to change their lifestyle and diet, it's relatively easy to stop using the CGM or cancel the subscription altogether. I imagine the lifetime value of a current customer is relatively low, given higher churn rates after a few months of use.

January AI CEO Noosheen Hashemi addressed this concern in a recent interview with Fitt Insider, stating that they are "banking on changing life circumstances [that] will keep people using the product to gain new predictive insight." Time will tell if this is true and users will in fact continue wearing the device after the first couple of months, but it will be necessary for CGM-focused firms to find ways to provide value beyond this initial trial period.

3.) Direct Integration

Another risk CGM-focused digital health companies face is existing and much larger wearable device companies integrating CGM data and insight directly into their products. Garmin is already doing this, allowing users to connect Dexom-collected data with their Garmin devices. If Garmin develops in-house interpretation capabilities or relies on AI models to drive insight gleaned from CGM data, there won't be as strong of a use case for the digital health platform. Direct integration into wearable devices could eliminate the software layer altogether.

4.) Substitute Products

Lastly, there is a lot of focus on blood glucose monitoring in the medical device space, and there are novel methods beyond a CGM to collect this data that are currently in development. As discussed in the competitor section, companies use photoacoustics, radiofrequency, and breath analysis to test the same data that a CGM collects. If new methods are more accurate and less invasive, CGM digital health companies will need to pivot to adopt the latest technologies or risk obsolescence.

Closing Thoughts

I'm excited about the potential health outcomes that CGM-focused digital health companies can drive in changing consumer behavior because there has never been a more vital need for change than right now. It’s a very competitive space with huge industry hurdles, but with the metabolic state of our nation and world in a tedious spot, the efforts of these companies and the investment firms funding them have never been more critical.