Dallas Mavericks Transaction

Dissecting Mark Cuban's sale of the Dallas Mavericks to the Adelson Family

Overview

On November 28th, 2023, Miriam Adelson, 44th richest person in the world and wife of recently deceased casino and resort mogul Sheldon Adelson, sold $2B of Las Vegas Sands stock (LVS) with the stated intention of using those funds in addition to cash on hand to acquire a professional sports franchise. Shortly after, news broke that she and the Adelson family would acquire a majority interest of Mark Cuban’s stake in the Dallas Mavericks.

Transaction Details

Full details of the transaction have not been released yet, but reports say that the team was valued at $3.5B. The Adelson family will be purchasing a majority stake from Cuban, but he will maintain a minority interest as well as control of basketball operations. The deal will now go through various league approvals but is expected to close by the end of the year. Assuming the NBA approves the transaction, Miriam Adelson will be among the few female majority owners of a US professional sports franchise.

NBA Investment

There has been a lot of media attention recently on sports franchises as an asset class, and I want to use this opportunity to discuss the trend through the lens of the Mavericks transaction.

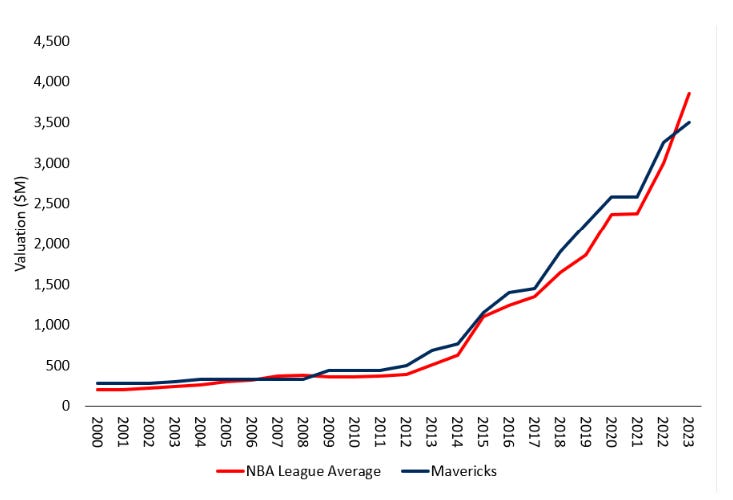

Cuban bought the Mavericks for $285M in 2000, and the value of the team has seen steady appreciation for his 23-year holding period. Chart 1 below shows the annual valuation estimate of the Mavericks through the hold period.

Note: All valuation data comes from either Sportico or Forbes, the two principal groups that provide estimates of Sports franchise valuations to the general public.

Given the discussed sale price of $3.5B, he had an 1128.1% Return on Investment (ROI) or a Compound Annual Growth Rate (CAGR) of 11.02%.

Note: Two important assumptions are 1.) For simplicity sake, I assumed he sold 100% of the franchise, and 2.) We are ignoring the fact that he may have invested additional capital into the team during this time.

The 11.02% CAGR compares to a 4.9% CAGR for the S&P 500 during that same timeframe. The difference in CAGR is driven by annual returns in addition to the volatility of those returns. The Mavericks (and NBA franchises in general) have experienced relatively steady appreciation without major pullbacks in valuation. The S&P 500, on the other hand, has had steady years, boom years, and bust years (like during the tech bubble and the great financial crisis). This is an important distinction because when losing 50% of the value in an investment, it takes a 100% increase to get back to breakeven, so this downside protection has a significant impact on total returns over the long run. Chart 2 below highlights the hypothetical growth of $1 invested into each asset starting from when Cuban bought the team in 2000.

Going one step beyond return metrics, we can compare the two asset classes by evaluating their volatility and excess returns above a risk-free rate given that volatility. The table below highlights the average 5-year return, the standard deviation (a measure of volatility), and the Sharpe Ratio (a measure of risk-adjusted return).

What this shows is that even though the two investments had similar 5-year average returns, the Dallas Mavericks had better risk-adjusted returns compared to the S&P, because it had lower volatility. This isn’t a perfect comparison because the Mavericks are not a liquid asset that prices daily, so the volatility is most likely understated, but it still presents an interesting case for investment in sports franchises.

How does this deal stack up with recent transactions and expected valuations for the Mavericks? As of year-end 2022, Sportico estimated the value of the Mavericks was $3.26B compared to the league average of $3.0B. Forbes has a more updated list for 2023 in which they estimated the value of the Mavericks at $4.5B vs. a league average of $3.85B.

The difference in actual valuation vs. expected could be due to Forbes and Sportico having incomplete information regarding the team’s financials or could be a result of Cuban accepting a lower valuation due to him maintaining control of the basketball operations and the synergies formed through the partnership with the Adelson family.

There are three comparable transactions of NBA teams this year 1.) Charlotte Hornets selling for $3.0B 2.) Milwaukee Bucks selling at a $3.5B valuation and 3.) Phoenix Suns selling at a $4.0B valuation. Chart 3 below shows the Maverick’s appreciation compared to the NBA league average. (As I was writing this post, it appears there is another transaction occurring for 15% of the Indiana Pacers at a $3.47B valuation.)

Deal Rationale

In addition to the financial motives, there could be other reasons as to why Cuban is selling specifically to the Adelson family. Cuban has previously discussed the potential for a significant renovation of the 22-year-old American Airlines arena, in addition to building out a resort and casino operation with the stadium being the centerpiece. Bringing in the Adelson family could be a strategic move to bring in additional deep-pocketed investors with operational expertise in the casino and entertainment space.

From the Adelson family perspective, beyond the consistent appreciation of NBA franchises in general, the Dallas-Fort Worth metropolitan area is the 4th largest in the United States (7,943,685 as of 2022), a massive media market, and the Mavericks have consistently been a top performing team in the NBA. The Mavericks have the second-highest winning percentage in the league since Cuban took over (59.6% compared to 39.4% for the period before he took over), have 1 Championship, and made the playoffs in 16 of the last 20 years.

Conclusion

With valuations at all-time highs, as well as the increasing involvement of institutional investment firms in sports, I expect to continue to see more deal activity in the NBA as well as the other major sports leagues. This deal was a bit of a surprise, though, given Cuban is highly visible and involved in the Mavericks organization. It could be an indication of him wanting to take some chips off the table while the market is hot or potentially foreshadow big development plans for the Mavericks organization. Regardless, I’m confident in saying this won’t be the last NBA transaction we see in the near future.